How To Calculate Loan Funds In Quickbooks

How To Calculate Loan Funds In Quickbooks

They can also counsel what account to create in your chart of accounts to deal with loans with late fees. Moreover, you’ll find a way to seek the advice of an accountant to make sure your information are in shipshape. They can present different suggestions or choices on how to properly handle loans with late fees, particularly with the category/account to use when dealing with them.

The query is how come they don’t perceive why this characteristic sucks. Please feel free to achieve out again and share your thoughts about dealing with invoices. Your insights are invaluable in serving to us enhance our software and provide a greater user expertise for you and our different prospects. I’m all the time right here able to help if you have some other considerations about managing buyer late charges in QuickBooks.

Click On on the bill to open it and proceed to the following step of incorporating the late charge into the billing details. You can simply Activate and configure the default late payment settings, which is very useful in to cost late fees on past-due invoices out of your customers. QuickBooks automatically adds late charges to overdue invoices for up to six months. This mortgage repayment formulation permits you to calculate the fixed periodic payment quantity needed to fully amortize a loan over a set number of months with fixed principal and interest rates.

Recent Posts

- QuickBooks Loan Manager is very customizable to meet the distinctive wants of each enterprise.

- This type of invoice reminder could be extremely effective in relation to encouraging clients to pay their invoices on time.

- By dealing with loan cost calculations in QuickBooks, customers save time and reduce the danger of errors that can happen with guide calculations.

- If you’re nonetheless unable to seek out the option, I suggest logging into your account via a non-public browser.

- If a mortgage cost is late, QuickBooks automatically calculates any late charges or penalties that the lender charges based mostly on the phrases of the mortgage.

• The Designing options are convenient.• Integration of accounting.• Instant and super fast supply.• Tracking could be very simple.• Payments are accomplished quick compared to other. Dancing Numbers helps small companies how to categorize late fees in quickbooks, entrepreneurs, and CPAs to do smart transferring of information to and from QuickBooks Online. Utilize import, export, and delete services of Dancing Numbers software program. Enable me to share further details about late charges in QuickBooks On-line. After turning on this performance, charges might be calculated on invoices that turn out to be overdue.

Turn On Computerized Late Fees

Right Here, you can see the “Late fees” possibility, which must be activated to allow the late payment function in QuickBooks. Click On on “Late fees” to entry the settings associated to late charge implementation and administration. QuickBooks Desktop provides extra flexibility for automating late charges, though it nonetheless requires manual setup and doesn’t provide fully automated late fee software.

Entry 20+ insightful built-in reports to know the health of your corporation. Manage your business on the go by accessing your account anywhere, anytime on any system. Increase your QuickBooks On-line functionality by simply syncing with 350+ apps. Seamlessly collaborate together with your accountant to make tax time a snap.

By following the step-by-step information outlined on this tutorial, you may have gained priceless insights into the seamless means of incorporating late fees into your QuickBooks invoices. Study how to arrange and apply late fees to overdue invoices mechanically in QuickBooks On-line. QuickBooks provides the instruments to facilitate this evaluate process, enabling you to observe and modify late fees as wanted. Furthermore, QuickBooks generates detailed records of late fee applications, allowing you to trace and evaluation the late charges imposed on particular invoices. This visibility enables you to keep correct financial information and facilitates communication with shoppers regarding any late charges incurred, selling transparency and accountability in your financial dealings.

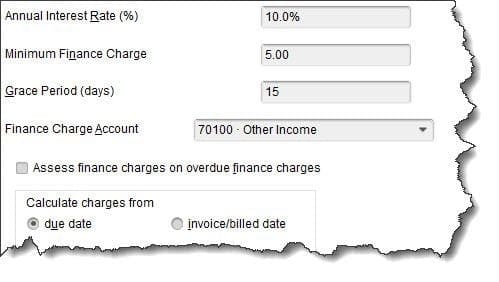

In the meantime, you can assess the finance charge of your invoice. I wished to verify it was figuring the quantity appropriately so I went under Edit, Preferences, Finance Charge and underneath Interest Rate it says 18.0% (previous proprietor will have to have added that). I am wondering how I ought to set this up if I just wish to cost 1.5% Month-to-month on overdue invoices? In order to precisely report your transactions, I highly advocate consulting an accounting specialist for skilled ideas.

It’s also a good suggestion to remind your shoppers forward of time about an impending late charge. Biller Genie’s “Upcoming Late Fee” reminder makes this straightforward (more on this below). By leveraging the capabilities of QuickBooks to seamlessly combine late charges, you may be poised to boost your monetary administration practices and promote sustainable business growth.

Step 1: Accessing The Late Payment Function

As Quickly As the mortgage is about up, QuickBooks can routinely calculate scheduled mortgage payments, together with principal and interest quantities. I recommend creating a separate expense account in QuickBooks to start including your loans with their corresponding late charges. The two accounts shall be used to track what you owe in addition to the additional quantity calculated for them. Earlier Than you’ll be able to begin setting up late charges in QuickBooks, it’s essential to ensure that the late charge characteristic is enabled inside the software program. To entry this function, start by logging into your QuickBooks account and navigating to the “Settings” or “Gear” icon, typically https://www.quickbooks-payroll.org/ positioned in the top right nook of the screen. From the dropdown menu, select “Account and Settings” to proceed to the account settings page.

All Categories

- ! Без рубрики

- 1

- 1 Win 242

- 1 Win 318

- 1 Win 342

- 1 Win 400

- 1 Win 508

- 1 Win 64

- 1 Win 694

- 1 Win 930

- 1 Win App Login 194

- 1 Win App Login 390

- 1 Win Bet 919

- 1 Win Colombia 739

- 1 Win Online 302

- 1 Win Online 440

- 1 Win Online 748

- 100

- 188 Bet Link 818

- 188bet Dang Ky 171

- 188bet Dang Ky 846

- 188bet Dang Nhap 766

- 188bet Terbaru 915

- 1vin 26

- 1vin 349

- 1vin 442

- 1win Apk 324

- 1win Apk 403

- 1win Apk 431

- 1win Apk 450

- 1win Apk 528

- 1win Apk 965

- 1win Apk Senegal 898

- 1win App 199

- 1win App 48

- 1win App 485

- 1win App 822

- 1win App 847

- 1win App 889

- 1win App 898

- 1win App 930

- 1win App 999

- 1win App Download 823

- 1win App Login 16

- 1win App Login 519

- 1win Apuestas 647

- 1win Argentina 446

- 1win Aviator 783

- 1win Bet 11

- 1win Bet 194

- 1win Bet 636

- 1win Bet 650

- 1win Bet 665

- 1win Bet 793

- 1win Bet 892

- 1win Bet 939

- 1win Bet 997

- 1win Bet Ghana 24

- 1win Betting 668

- 1win Bonus 12

- 1win Bonus 365

- 1win Burkina Faso Apk 633

- 1win Cameroon 778

- 1win Casino 123

- 1win Casino 157

- 1win Casino 218

- 1win Casino 241

- 1win Casino 289

- 1win Casino 516

- 1win Casino 626

- 1win Casino 649

- 1win Casino 680

- 1win Casino 681

- 1win Casino 683

- 1win Casino 728

- 1win Casino 750

- 1win Casino 753

- 1win Casino 801

- 1win Casino 831

- 1win Casino 870

- 1win Casino 871

- 1win Casino 98

- 1win Casino Login 867

- 1win Casino Online 19

- 1win Casino Online 911

- 1win Colombia 818

- 1win Colombia 984

- 1win Download 540

- 1win Download 549

- 1win Download 616

- 1win Games 110

- 1win Games 241

- 1win India 508

- 1win Kazahstan 176

- 1win Kazahstan 754

- 1win Kazino 368

- 1win Kz 255

- 1win Kz Skachat 929

- 1win Login 235

- 1win Login 260

- 1win Login 283

- 1win Login 310

- 1win Login 319

- 1win Login 386

- 1win Login 514

- 1win Login 57

- 1win Login 654

- 1win Login 814

- 1win Login 900

- 1win Login Kenya 576

- 1win Login Nigeria 909

- 1win Official 305

- 1win Official 389

- 1win Official 927

- 1win Ofitsialnii Sait 183

- 1win Onlain 139

- 1win Onlain 227

- 1win Onlain 723

- 1win Online 282

- 1win Online 413

- 1win Online 540

- 1win Online 557

- 1win Online 570

- 1win Online 585

- 1win Online 751

- 1win Online 93

- 1win Online 965

- 1win Oyna 517

- 1win Peru 6

- 1win Philippines 564

- 1win Promo Code 431

- 1win Register 502

- 1win Register 994

- 1win Register Login 891

- 1win Registratsiya 988

- 1win Sait 271

- 1win Sait 624

- 1win Sait 973

- 1win Senegal 616

- 1win Senegal Apk 413

- 1win Senegal Telecharger 335

- 1win Site 319

- 1win Skachat 142

- 1win Skachat 198

- 1win Skachat 240

- 1win Skachat 655

- 1win Skachat 847

- 1win Skachat 951

- 1win Skachat Tj 664

- 1win Slot 960

- 1win South Africa 245

- 1win Telecharger 302

- 1win 먹튀 810

- 1xbet4

- 2

- 20 Bet 149

- 20 Bet Casino 822

- 20 Bet Login 992

- 20bet App 222

- 20bet Apuestas 829

- 20bet Bonus Code Ohne Einzahlung 127

- 20bet Brasil 216

- 20bet Casino No Deposit Bonus Code 809

- 20bet Casino No Deposit Bonus Code 875

- 20bet Live 645

- 20bet Promo Code 346

- 20bet Εισοδος 43

- 20bet Τηλεφωνο Επικοινωνιας 207

- 20bet 登録 268

- 20bet 登録方法 647

- 22bet Apk 743

- 22bet Casino Espana 30

- 22bet Casino Espana 33

- 22bet Casino Login 656

- 2casino

- 4122

- 5gringoscasinoitalia.com

- 5gringosdeutschland.com

- 7 Games Cassino 648

- 777 Slot 50

- 777 Slot Vip 769

- 777-bdcasino.com

- 7bitcasinoaustralia.net

- 7bitcasinocanada.net

- 7bitcasinonz.net

- 888 Online Casino 694

- 888casinobelgium.com

- 888casinomexico.com

- 8x Bet 425

- 8xbet Apk 526

- 8xbet App Tai 790

- 8xbet Dang Nhap 836

- 8xbet Download 538

- 8xbet Online 302

- 8xbet Vina 630

- a16z generative ai

- Aajogo Bet 213

- adobe generative ai 2

- ai chat bot python

- alpinocasinoitalia.com

- amunracasinoitalia.net

- amunrahungary.net

- ancorallZ 1500

- ancorallZ 2000

- App Vai De Bet 531

- Avantgarde Casino Welcome Bonus 866

- avantgardecasinoaustralia.net

- avantgardecasinouk.uk

- Aviator Mostbet 70

- Aviator Mostbet 721

- Aviator Mostbet 755

- Aviator Mostbet 889

- Aviator Online 302

- Baji App Login 262

- bankonbetes.net

- bankonbetfr.com

- bcg3

- bcgame1

- bcgame2

- bcgame3

- bcgame4

- bcgame5

- bd888casino.com

- Bdm Bet Espana 73

- bestdiplomsa.com

- Bet 365 200

- betalandcasinoitalia.com

- Betandreas Azerbaycan 564

- Betano Casino Ao Vivo 543

- betano-casino-cz.com

- betano-casino.us

- betanobgcasino.com

- betanocasinodk.com

- betanocasinoperu.com

- betanocasinoro.com

- betcasino1

- Betflag Slot 664

- Betpix Oficial 803

- Betriot App 10

- Betriot Bonus 31

- Betriot Bonus 78

- Betriot Casino 166

- Betriot Casino Italy 680

- betty-wins-casino.us

- bettycasinocanada.net

- bettyspinfrance.com

- bettyspinitalia.com

- bettyspinosterreich.com

- betwaycasinomexico.com

- betwinner1

- betwinneк2

- bigbassbonanza.cc

- bigbasssplash.com.es

- bitstarzcasino.co.uk

- bizzo-casino.us

- bizzocasinohungary.net

- Blog

- Bmw Slot Casino 805

- bobcasinocanada.com

- bobcasinofr.com

- bobcasinoosterreich.com

- Bono Gratogana 36

- Bonus Bez Depozytu Ggbet 43

- Bookkeeping

- bookmakers1

- boomerangcasinoitalia.net

- bou-sosh6.ru 36

- brangocasinocanada.net

- brbetanocasino.com

- buy-auto-spb.ru

- cashedcasinoitalia.com

- casiniamagyar.com

- Casino

- Casino Days Mobile 314

- Casino Gg Bet 371

- Casino Mostbet 736

- Casino Mostbet 84

- Casino Mostbet 993

- Casino Nv 872

- Casino Pin Up 438

- Casino Yabby 74

- casino-world.uk

- casino0212

- casino1

- casino2

- casino3

- casino5

- casinobet1

- casinobet13

- casinobet17

- casinobet18

- casinobet28

- casinobet29

- casinobet3

- casinobet30

- casinobet31

- casinobet32

- casinobet33

- casinobet4

- casinobet5

- casinoclassicuk.uk

- casinofridaynorge.org

- casinojaya9

- Casinomania Bonus Senza Deposito 980

- casinomaniaitalia.net

- casinoslot1

- casinoslot3

- casinoslot4

- casinotropezcanada.com

- casono02123

- caxinocasinosuomi.com

- cazimbocasinoitalia.com

- Chicken Road Casino 211

- Chicken Road Casino 554

- Chicken Road Demo 282

- chickenroadcanada.org

- classiccasinonz.com

- Codice Promozionale Casino Mania 572

- Codigo Promocional Betano 732

- coolzinodeutschland.com

- coolzinoportugal.com

- corgibetaustralia.com

- corgibetespana.com

- corgibetslovenija.com

- Crickex Casino 661

- crystalrollnl.org

- Culinary & Gastronomic Journeys

- Darmowe Spiny Energycasino 987

- Demo Slot Jili 357

- Digital Detox & Mindful Retreats

- digitalgmu.ru 2000

- diplomrums

- diplomrums1

- dollycasinoaustralia.net

- dollycasinopl.com

- egu-diplom

- en 1430

- Energi Casino 382

- Energy Kasyno 633

- Energycasino Bonus Bez Depozytu 482

- Energycasino No Deposit Bonus 423

- Experiential & Cultural Adventures

- extreme-casino-canada.net

- Fb 777 Casino Login 787

- Fb777 Pro 753

- Fb777 Pro Login 608

- Fb777 Slot Casino 659

- Fb777 Win 93

- felixspin.us

- Forex Trading

- Free Spin Casino 167

- gambloriaespana.com

- gambloriaitalia.com

- gambloriaportugal.com

- Gamdom Casino 30

- Gbg Bet Login 835

- generative art ai 1

- gold blitz extreme

- Goldbet Casino App 431

- goldblitzextreme.com

- golden-tiger-casino-canada.com

- goldentigercasinodeutsch.com

- grandmondialcasinoslovensko.com

- gransinofrance.com

- Gratogana App 151

- Hell Spin 22 797

- Hell Spin Bonus 101

- Hell Spin Casino 925

- Hellspin Casino 159

- Hellspin Casino 426

- Hellspin Casino App 386

- Hellspin Casino Bewertung 858

- Hellspin Casino Login 484

- Hellspin Casino No Deposit Bonus 339

- Hellspin Casino Review 282

- Hellspin Kod Bonusowy Bez Depozytu 50

- Hellspin Login 21

- Hellspin Login 784

- Hellspin Promo Code 232

- Hellspin Review 174

- hellspinaustralia.win

- hellspindeutschland.com

- hellspingreece.com

- hellspinosterreich.com

- hellspinpl.net

- highflybetfrance.com

- highflybetitalia.com

- highflybetpolska.com

- highflybetportugal.com

- Hit Spin 892

- Hitnspin Casino 574

- Hitnspin Casino Login 528

- Hitnspins 273

- Hospitality Technology Innovations

- Hungary

- Ice Casino Login 957

- Ice Casino Zaloguj 181

- Immediate Edge Sito Ufficiale 550

- inglesina-italy.ru 10

- Is Galactic Wins Legit 345

- italia

- Jackpotcity 615

- jackpotcitycasinocanada.com

- jackpotcitycasinofrancais.com

- jackpotcitymexico.com

- jackpotjillvipaustralia.com

- Jak Wyplacic Pieniadze Z Ice Casino 978

- jet-casino-brasil.com

- jet-casino-osterreich.com

- jet-casino-uk.uk

- jetcasinodeutschland.com

- Jeux Du Poulet Casino 566

- Jili Slot 777 Login 723

- joefortuneaustralia.net

- joocasino.us

- jos-trust

- kingbilly.us

- kingmakercasinoaustralia.net

- kingmakercasinoitalia.net

- Lalabet App Download 410

- legianocasinofrance.net

- legzo-casino-de.org

- legzocasinocanada.com

- Lemon Casino 50 Free Spins 11

- Lemon Casino Kod Promocyjny 694

- Lemon Casino Opinie 132

- Lemon Kasyno 873

- Lemonkasyno 37

- leoncasinoportugal.com

- Level Up Casino App 521

- Level Up Casino App Download 688

- Level Up Casino Australia Login 470

- Level Up Casino Australia Login 728

- Level Up Casino Login 315

- Level Up Online Casino 464

- Levelup Casino Australia 711

- Levelupcasino 672

- Lex Casino Bonus Code 255

- Life Style

- Link Vao 188bet 136

- Link Vao 188bet 481

- Link Vao 188bet 713

- Link Vao 188bet 98

- liraspinespana.com

- Lotto Total Casino 910

- Lucky Cola Login 952

- Lucky Cola Slot Login 757

- Lucky Cola Vip 171

- Luckybird Io 319

- luckygreencasino.us

- luckyhunteruk.uk

- luckyonescasino.us

- luckyonescasinocanada.net

- lukkicasinoaustralia.org

- lukkicasinodeutschland.com

- lukkicasinonorge.com

- lukkicasinonz.net

- Luva Bet Casino Online 886

- Luva Bet Com Login 930

- luxurycasinonz.com

- magiuscasino.us

- magiuscasinofrance.net

- magiuscasinohungary.com

- malinacasinoitalia.com

- mbousosh10.ru 4-8

- megamedusacasinoaustralia.com

- meilleurcasinoenlignefrance.net

- Milky Way Casino App 30

- millioncasinoitalia.com

- millionercasinoaustralia.com

- millionercasinofrance.com

- millionercasinoitalia.com

- millionercasinopolska.com

- Mines 1win 756

- Most Bet 138

- Most Bet 145

- Most Bet 374

- Most Bet 562

- Most Bet 638

- Most Bet 685

- Most Bet 8

- Most Bet 805

- Most Bet 861

- Most Bet 862

- Most Bet 979

- Mostbet 100 Free Spins 947

- Mostbet 30 Free Spins 203

- Mostbet 30 Free Spins 512

- Mostbet 30 Free Spins 578

- Mostbet 30 Free Spins 646

- Mostbet 910

- Mostbet Apk 435

- Mostbet Apk 543

- Mostbet Apk Download 86

- Mostbet App 200

- Mostbet App 294

- Mostbet App 360

- Mostbet App 373

- Mostbet App 394

- Mostbet App 479

- Mostbet App 613

- Mostbet App 829

- Mostbet App 932

- Mostbet App Android 745

- Mostbet App Download 870

- Mostbet App Download Nepal 817

- Mostbet Apps 631

- Mostbet Aviator 184

- Mostbet Aviator 219

- Mostbet Aviator 257

- Mostbet Aviator 383

- Mostbet Aviator 476

- Mostbet Aviator 675

- Mostbet Aviator 728

- Mostbet Aviator 758

- Mostbet Aviator 886

- Mostbet Aviator 934

- Mostbet Aviator 990

- Mostbet Bd 839

- Mostbet Bet 660

- Mostbet Bezdepozitnii Bonus 60

- Mostbet Bezdepozitnii Bonus 724

- Mostbet Bezdepozitnii Bonus 887

- Mostbet Bonus 254

- Mostbet Bonus 687

- Mostbet Bonus 834

- Mostbet Bonus 854

- Mostbet Bonus 920

- Mostbet Brasil 845

- Mostbet Casino 152

- Mostbet Casino 269

- Mostbet Casino 296

- Mostbet Casino 327

- Mostbet Casino 412

- Mostbet Casino 49

- Mostbet Casino 567

- Mostbet Casino 59

- Mostbet Casino 599

- Mostbet Casino 631

- Mostbet Casino 639

- Mostbet Casino 750

- Mostbet Casino 798

- Mostbet Casino 87

- Mostbet Casino 886

- Mostbet Casino 920

- Mostbet Casino 995

- Mostbet Casino Bonus 708

- Mostbet Casino Login 112

- Mostbet Casino Login 402

- Mostbet Casino Login 410

- Mostbet Casino Login 78

- Mostbet Casino Login 845

- Mostbet Codigo Promocional 741

- Mostbet Cz 68

- Mostbet Cz 84

- Mostbet Cz 876

- Mostbet Entrar 422

- Mostbet Es Confiable 431

- Mostbet Free Spin 378

- Mostbet Game 456

- Mostbet Game 707

- Mostbet Giris 440

- Mostbet Hungary 473

- Mostbet Hungary 697

- Mostbet Indir 566

- Mostbet Kazino 18

- Mostbet Kazino 43

- Mostbet Kazino 723

- Mostbet Kazino 813

- Mostbet Kazino Kazahstan 470

- Mostbet Kazino Skachat 228

- Mostbet Kg 381

- Mostbet Kirish 344

- Mostbet Kz 417

- Mostbet Live 848

- Mostbet Login 255

- Mostbet Login 539

- Mostbet Login 715

- Mostbet Login 753

- Mostbet Login 782

- Mostbet Login 816

- Mostbet Login 854

- Mostbet Login 949

- Mostbet Login 971

- Mostbet Login India 106

- Mostbet Mexico 892

- Mostbet Mobile 864

- Mostbet Nepal 582

- Mostbet No Deposit Bonus 212

- Mostbet Online 169

- Mostbet Online 533

- Mostbet Online 666

- Mostbet Otzivi 969

- Mostbet Oynash 480

- Mostbet Peru 612

- Mostbet Pk 143

- Mostbet Prihlaseni 399

- Mostbet Promo Code 261

- Mostbet Promo Code 337

- Mostbet Promo Code 786

- Mostbet Promo Code Hungary 495

- Mostbet Promo Code No Deposit 692

- Mostbet Promokod 556

- Mostbet Register 327

- Mostbet Register 873

- Mostbet Register 914

- Mostbet Registrace 265

- Mostbet Registrace 456

- Mostbet Registrace 793

- Mostbet Registrace 819

- Mostbet Registration 231

- Mostbet Registration 27

- Mostbet Registration 763

- Mostbet Royxatdan Otish 140

- Mostbet Royxatdan Otish 996

- Mostbet Sayti 762

- Mostbet Skachat 565

- Mostbet Skachat Android 55

- Mostbet Turkiye 775

- Mostbet Ua 967

- Mostbet Uz 754

- Mostbet Uz Kirish 541

- Mostbet Uz Kirish 790

- Mostbet Uz Registratsiya 701

- Mostbet Uzbekistan 547

- Mostbet Yukle 102

- Mostbet Yukleme 354

- Mostbet تنزيل 381

- Mostbet تنزيل 731

- Mostbet লগইন 836

- mr-fortune-casino-nz.com

- mrfortunecasinocanada.com

- myempirecasinoespana.com

- mystakecasinoitalia.com

- n1betaustralia.com

- n1betitalia.com

- n1casino.us

- n1casinoat.com

- n1casinonederland.com

- national-casino.us

- needforslotscanada.com

- needforslotsespana.com

- neospinaustralia.net

- neospincasinoaustralia.net

- NEW

- News

- Novibet Aposta 916

- Nv Casino Opinie 557

- Nv Kasyno 20€ No Deposit Bonus 181

- Nv Kasyno Online 636

- Nv Kasyno Review 503

- Nvcasino 733

- oct_mb

- Onabet Jogo 6

- ozwincasino.uk

- pacific-spins-casinonz.com

- Partycasino Es 729

- partycasinoaustria.com

- Phlwin Free 100 No Deposit Bonus 365

- Phlwin Login 47

- Phlwin Online Casino Hash 36

- Photographer 453

- Pin Ap Kazahstan 623

- Pin Ap Kz 412

- Pin Up 241

- Pin Up 27

- Pin Up 286

- Pin Up 413

- Pin Up 429

- Pin Up 519

- Pin Up 641

- Pin Up 92

- Pin Up Apuestas 917

- Pin Up Apuestas Deportivas 364

- Pin Up Aviator 46

- Pin Up Az 46

- Pin Up Azerbaycan 467

- Pin Up Bangladesh 911

- Pin Up Bet 156

- Pin Up Bet 80

- Pin Up Bet 936

- Pin Up Bet Login 511

- Pin Up Brasil 796

- Pin Up Casino 102

- Pin Up Casino 142

- Pin Up Casino 446

- Pin Up Casino 703

- Pin Up Casino 714

- Pin Up Casino 718

- Pin Up Casino 735

- Pin Up Casino 756

- Pin Up Casino 781

- Pin Up Casino 836

- Pin Up Casino 93

- Pin Up Casino Aviator 465

- Pin Up Casino En Linea 852

- Pin Up Casino En Linea 978

- Pin Up Casino Giris 208

- Pin Up Casino Giris 231

- Pin Up Casino India 245

- Pin Up Casino India 345

- Pin Up Casino Indir 258

- Pin Up Casino Indir 380

- Pin Up Casino Login 141

- Pin Up Casino Login 333

- Pin Up Casino Login 836

- Pin Up Casino Online 559

- Pin Up India 294

- Pin Up Kazino 250

- Pin Up Kazino 892

- Pin Up Kazino Igrat 86

- Pin Up Login 312

- Pin Up Login 984

- Pin Up Online 484

- Pin Up Online 795

- Pin Up Online Casino 498

- Pin Up Online Casino 539

- Pin Up Online Casino 563

- Pin Up Online Casino 998

- Pin Up Oyunu 958

- Pin Up Peru 239

- Pin Up Skachat 882

- Pin Up Uzbekistan 321

- Pin Up World 259

- Pin Up World 467

- Pin Up World Casino 555

- Pinap 450

- Pinap Kazino 862

- Pinup 122

- Pinup 271

- Pinup 353

- Pinup 39

- Pinup 496

- Pinup 540

- Pinup 582

- Pinup Casino 274

- Pinup Casino 678

- Pinup Casino 918

- Pinup Casino 975

- Pinup Casino App 195

- Pinup Chile 462

- Pinup Peru 32

- Pinupcasino 606

- pirs67.ru 50

- pistolocasino.us

- pistolocasinodeutschland.com

- pistolocasinogreece.com

- Pixbet App 2024 993

- Play Croco Casino Login 37

- Playcroco Online Casino 770

- playcroco-casino-australia.net

- playcrococasinoaustralia.net

- plinkogame.com.es

- pokerstarscasinoitalia.net

- pokerstarscasinoslovenija.com

- posidocasinoespana.com

- Post

- quatrocasinoaustria.com

- quatrocasinocanada.org

- quatrocasinofrancais.com

- Que Es Mostbet 640

- rabonacanada.com

- rabonacasinoitalia.com

- rabonanorge.com

- rabonaportugal.com

- ragingbullcasinoitalia.com

- razedcasinocanada.com

- razedcasinonz.com

- ready_text

- reidovo-school.ru 120

- retrobetaustralia.com

- retrobetosterreich.com

- Rhino Bet Casino 335

- richardcasinoaustralia.net

- riverbellecasinoca.com

- rocketplayosterreich.com

- rodeoslotsbelgie.com

- rodeoslotsitalia.com

- rollxoitalia.com

- rooli-casinonz.net

- roolicasinoaustralia.net

- roolicasinodeutschland.com

- roulettinoaustralia.com

- roulettinodeutschland.com

- roulettinoespana.com

- roulettinogreece.com

- roulettinoitalia.com

- Royal Vegas 1 Deposit 817

- Royalvegas 356

- Rt Bet 328

- Rtbet Bonus 602

- Rtbet Casino It 453

- rtbetpl.com

- rtbetsuomi.com

- Satbet Download 246

- sep

- sgcasinoespana.com

- skovorodkaclub.ru 50

- sky-crown-australia.net

- Sky247 Live 13

- Skycity Online Casino No Deposit Bonus 294

- slotlordscasinocanada.com

- slotmafiadeutschland.com

- slotmafianz.com

- Slottica Aplikacja Android 749

- Slottica Bonus 493

- Slottica Brasil 165

- Slottica Brasil 28

- Slottica Casino 332

- Slottica Cassino 413

- Slottica Download 399

- Slottica Jak Wyplacic Pieniadze 818

- Slottica Logowanie 645

- snatchcasinoitalia.com

- sol-casino-uk.uk

- solcasinoespana.com

- Spin Away Casino 275

- Spin Away Casino 298

- Spin Casino No Deposit Bonus 817

- Spin Casino Online 915

- spinawaycasinocanada.net

- spincitycasinopl.com

- spinmachodeutschland.com

- spinmachofrance.com

- spinpalacecasinocanada.com

- spinsycasinocanada.com

- Spinz 727

- spinzcasinode.com

- spinzcasinosuomi.com

- spiritcasinodeutscland.com

- spiritcasinoosterreich.com

- stakecasinoitalia.net

- Starcasino Online 741

- Starz 888 Bet 653

- stellarspinscasinoaustralia.com

- sushi 1

- Sustainable & Eco-Conscious Travel

- t.meriobet_zerkalo_na_segodnya 3000

- Tadhana Slot 777 923

- test

- tikitakacasinogreece.com

- Total Casino Demo 93

- Total Casino Kiedy Grac 41

- Total Casino Logowanie 773

- TP2 3900

- uncategorized

- Up X

- Uptown Pokies Australia 114

- Uptown Pokies Australia 297

- Uptown Pokies Bonus Codes 786

- Uptown Pokies Login 39

- Uptown Pokies Review 232

- Uptownpokies 468

- Uptownpokies 620

- Vai De Bet Cassino 357

- Vai De Bet Login Entrar 945

- Vegas 11 486

- verdecasinoitalia.net

- verdecasinolatvia.com

- verdecasinolt.net

- voddscasino

- Vulkan Vegas Free Spins 526

- Vulkanvegas 264

- vulkanvegasitalia.com

- wazambacasinoaustralia.net

- wazambaitalia.net

- wazambaschweiz.com

- websitepromotion6

- Wellness & Longevity Escapes

- what does nlu mean 8

- wheelzcasinonz.com

- wheelzcasinosuomi.com

- Win Spark Login 588

- winnitacasinoitalia.com

- winsharkcasinoaustralia.com

- Winspark 5 Euro Gratis 805

- winspiritaustralia.org

- wolfwinneraustralia.net

- woocasinoaustralia.net

- yabbycasinosouthafrica.com

- Yukon Gold Casino 150 Free Spins 12

- yukongoldcasinoireland.com

- yukongoldcasinoslovensko.com

- yukongoldcasinouk.uk

- Zet Casino Review 582

- zeusvshadesslot.net

- zodiac-casino-canada.net

- zodiaccasinonz.org

- zodiaccasinoslovenija.com

- Новини

- Новости Форекс

- تحميل Mostbet للاندرويد 753

Tags